BYD Disrupts Intelligent Driving Price War

Advertisements

The automotive world has recently witnessed a significant transformation, particularly with the soaring advancements in intelligence driving technology. One of the most notable developments is the strategic unveiling by BYD on February 10th, which not only sent shockwaves through the industry but also redefined the landscape of intelligent driving systems. At the core of this initiative is the self-developed "Heavenly Eye" advanced driver assistance system, which BYD announced would be available across its entire range of models, making smart driving more accessible than ever. Prices are set to plunge into an unprecedented segment starting at around 70,000 yuan, leading to the emergence of the oceanic Seagull as the world’s most affordable intelligent driving vehicle. This bold move undermines the unspoken industry jargon that advanced driving technology must equate to exorbitant costs, a sentiment echoed by BYD's chairman, Wang Chuanfu, who proclaimed that in the coming years, vehicles lacking smart driving capabilities will be as rare as those without airbags.

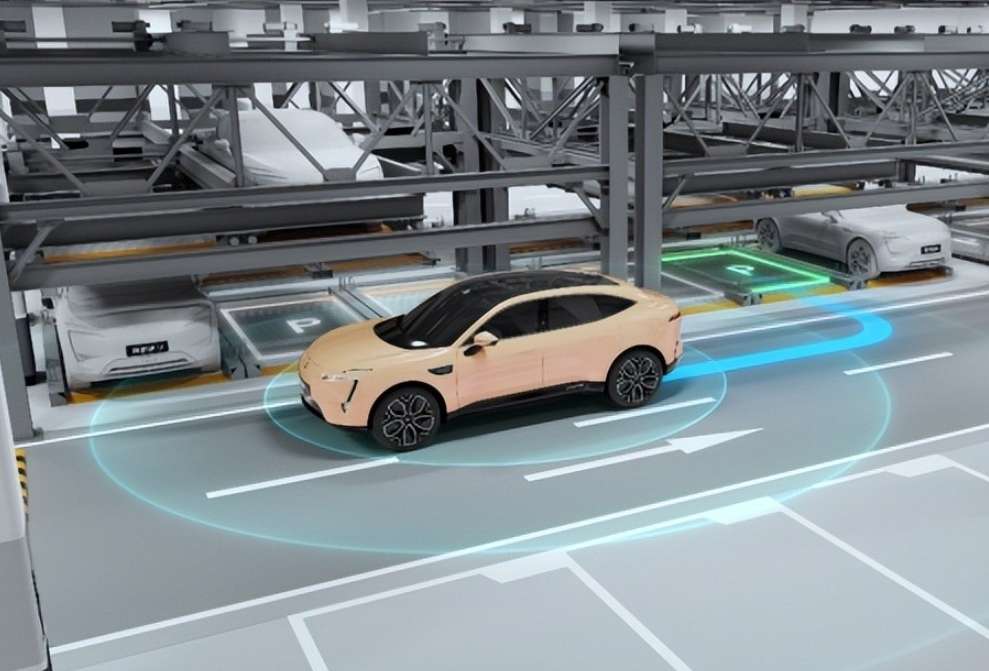

The "Heavenly Eye" system is stratified into three versions: A (the three-laser variant for the Yangwang brand), B (the high-end laser variant for Denza/BYD), and C (the mainstream three-lens version from BYD). The C version, notably equipped with a "three-lens camera + 5R12V sensor" setup, covers essential functions such as highway piloting and valet parking. What's more, this version supports over-the-air (OTA) upgrades for memory navigation in urban settings. Among the first batch of 21 models launched, vehicles priced below 100,000 yuan are universally adopting intelligent driving, those around 150,000 yuan are equipped with standard highway Navigation on Autopilot (NOA), while models above 200,000 yuan are fitted with laser radar versions. According to BYD, this technology has the potential to decrease fatigue-driving-related accidents by 21%, while fatalities could plummet by as much as 83%, directly addressing consumer safety concerns.

On the contrary, Huawei’s approach presents a fascinating juxtaposition. With its deeply-rooted ICT expertise, Huawei has developed the QianKun ADS 3.0 system, which brings an omnidirectional "parking to parking" operational capability. Seen on high-end models like the Fang Cheng Bao B8, this system supports complex decision-making under varied traffic conditions, including urban environments without images. However, while the base version of the Wanjie M7 Pro is priced at 249,800 yuan, it notably lacks laser radar, with features limited to highway piloting. Moreover, Huawei's partnership with Chang'an, which has yielded the Deep Blue series, is attempting to provide lane cruise assistance in urban settings within the mid-150,000 yuan range, yet the premium laser radar variants remain within the higher price brackets. This dynamic starkly contrasts with BYD’s mission to democratize intelligent driving.

At the heart of this technological rivalry is a complex interplay among algorithms, hardware, and real-world scenarios. From a technical perspective, BYD's "Heavenly Eye" C version leverages a visual and millimeter-wave sensor fusion approach. This strategy optimizes cost control and facilitates swift adoption. However, urban navigation relies heavily on future OTA updates. Conversely, Huawei's ADS 3.0 emphasizes a comprehensive end-to-end algorithm paired with redundant laser radar systems, showcasing a more sophisticated maturity in tackling complex urban situations. In safety terms, BYD relies on a "humanoid safety net" design, ensuring dual safety measures through regulatory control neural networks. In contrast, Huawei thrives on its AI chips and full-stack in-house development, boasting robust performance under extreme conditions.

As the clash between affordability and high-end specifications rages on, the question arises: who will shape the future? BYD's "technology equity" strategy undeniably accelerates the widespread integration of intelligent driving, but it falls short in certain functional aspects when compared to Huawei’s offerings. For instance, the Deep Blue S7, priced similarly at around 150,000 yuan, already provides urban cruise control capabilities, while comparable BYD models only standardize highway NOA within that price point. This divergence points to an intense competition among companies, with varying products showcasing distinct functional and pricing concepts. Analyzing market dynamics, BYD's inclusive strategy stands a strong chance at swiftly capturing market shares, promoting smart driving technology among the broader populace, whereas Huawei's premium approach aims to set technological benchmarks, steering the evolution of intelligent driving accessibility.

Looking ahead to 2025, which may herald the "Year of Intelligent Driving," it emerges that consumers stand to gain the most from this competitive exchange. BYD disrupts market norms with its pricing while Huawei establishes high technological standards—together, they transition intelligent driving from an exclusive luxury into a prevalent feature of automotive design. Consumers now find themselves at a pivotal juncture, where if they prioritize cost-effectiveness and practicality, BYD’s sub-70,000 yuan intelligent driving models are hard to overlook. Conversely, those desiring an all-encompassing immersive experience are drawn to Huawei's advanced ADS systems, representing leaders in technological innovation.

In this industry duel, it appears there are no losers, only the heralding of an upgraded, instinctive driving experience that prioritizes safety, efficiency, and accessibility. This rising competition catalyzes rapid advancements in intelligent driving technology, positioning China prominently on the global automotive stage. As technologies evolve and markets mature, intelligent driving is set to become an essential feature in vehicles, ushering in smarter, safer, and more user-friendly travel solutions. The automotive landscape is poised not just for ground-level changes, but also for innovation in services and performance from both BYD and Huawei—a future where intelligent driving is an intrinsic element of the consumer journey.

Post Comment